How To Use Bitcoin Cycles To Improve Your Investments

Bitcoin, the pioneering cryptocurrency, has been at the forefront of the digital currency revolution. Its price movements are often characterized by pronounced cycles of booms and busts, making it an intriguing yet challenging asset for investors. Understanding Bitcoin’s cyclicality can provide valuable insights and opportunities for strategic investment. In this article, we will delve into the concept of Bitcoin’s market cycles, explore how to leverage these cycles for investment, and explain how Cornerswap can help you navigate this dynamic market.

Understanding Market Cycles

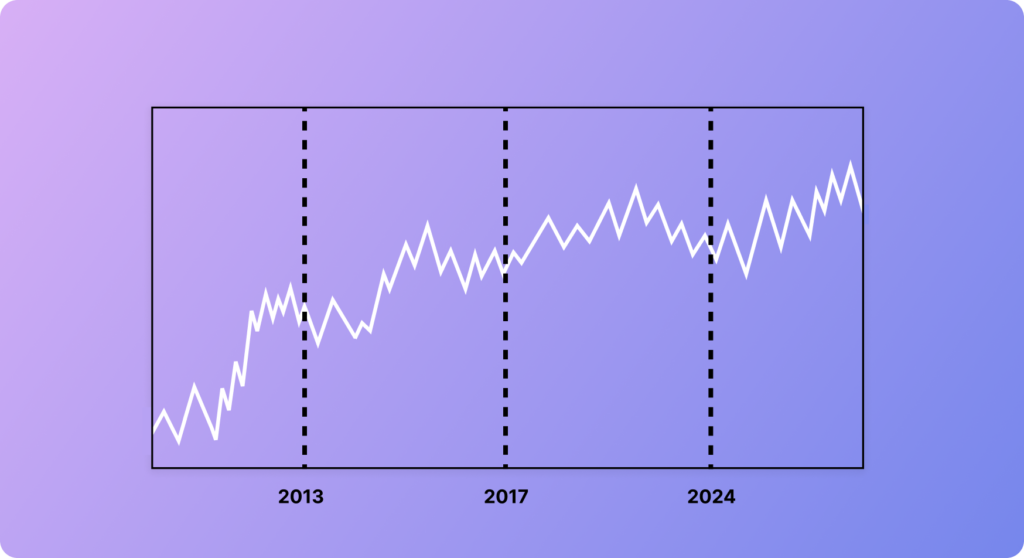

Market cycles refer to the recurring phases of growth and decline observed in financial markets. Bitcoin’s market cycles are typically more volatile and pronounced compared to traditional assets, driven by factors such as technological advancements, regulatory developments, market sentiment, and macroeconomic trends.

Phases of Bitcoin Market Cycles

- Accumulation Phase

- During this phase, the market is generally quiet, and Bitcoin’s price remains relatively stable or slowly increases. Smart money and long-term investors start accumulating Bitcoin, anticipating future growth.

- Bull Phase

- Characterized by rapid price increases, this phase sees heightened investor interest and media attention. Retail investors often enter the market, driving prices even higher.

- Distribution Phase

- In this phase, early investors start taking profits, leading to increased selling pressure. The market may still experience high volatility, with price spikes and corrections.

- Bear Phase

- Marked by significant price declines, this phase sees widespread pessimism and fear. Many retail investors exit the market, leading to further price drops. Eventually, the market stabilizes and prepares for the next accumulation phase.

Why Invest Based on Bitcoin Cyclicality?

By understanding Bitcoin’s market cycles, investors can make more informed decisions about when to enter and exit the market. Timing investments to align with different phases of the cycle can enhance returns and minimize losses.

Capitalizing on Volatility

Bitcoin’s pronounced cyclicality offers opportunities for substantial gains, especially during the bull phase. Savvy investors can capitalize on price movements by strategically buying during the accumulation and bear phases and selling during the bull and distribution phases.

Advantages of Investing Based on Cyclicality

- Informed Decision-Making

Investing based on cyclicality allows investors to make decisions grounded in historical patterns and market behavior, reducing the influence of emotions and impulsive actions. - Potential for Higher Returns

By aligning investments with market cycles, investors can potentially achieve higher returns by buying low and selling high, taking advantage of Bitcoin’s volatility. - Risk Management

Understanding cyclicality helps investors anticipate market downturns and implement risk management strategies, such as diversifying portfolios and setting stop-loss orders, to protect their capital.

Disadvantages of Investing Based on Cyclicality

- Complexity

Accurately identifying market phases and timing investments can be challenging, especially for beginners. Misjudging the cycle can lead to missed opportunities or losses. - Market Unpredictability

While historical patterns provide valuable insights, the cryptocurrency market remains highly unpredictable. External factors, such as regulatory changes or macroeconomic events, can disrupt expected cycles. - Emotional Challenges

Investing based on cyclicality requires discipline and emotional resilience. Investors must resist the urge to make impulsive decisions based on short-term market movements.

Tips for Successful Cyclicality-Based Investing

- Diversify Your Portfolio

While focusing on Bitcoin’s cyclicality, it’s important to diversify your investments across different assets to mitigate risk and enhance returns. - Stay Informed

Keep yourself updated with the latest news and trends in the cryptocurrency market. External factors can impact market cycles, and staying informed helps you make better investment decisions. - Be Patient and Disciplined

Investing based on cyclicality requires patience and discipline. Stick to your strategy and avoid making impulsive decisions based on short-term market fluctuations. - Implement Risk Management Strategies

Use risk management techniques, such as setting stop-loss orders and position sizing, to protect your capital and minimize potential losses.

Summary

Investing based on Bitcoin’s cyclicality offers a strategic approach to navigating the volatile cryptocurrency market. By understanding and leveraging market cycles, investors can make informed decisions, capitalize on price movements, and enhance their returns.