DCA Strategy: How To Invest Effectively In Crypto

Investing in cryptocurrency can be daunting, especially for newcomers. The volatile nature of the market often leads to hesitation and fear of making wrong decisions. However, there is a strategy that can help mitigate these risks and simplify the investment process: Dollar-Cost Averaging (DCA). In this article, we’ll explore what DCA is, how it works, and its advantages and disadvantages.

Understanding DCA

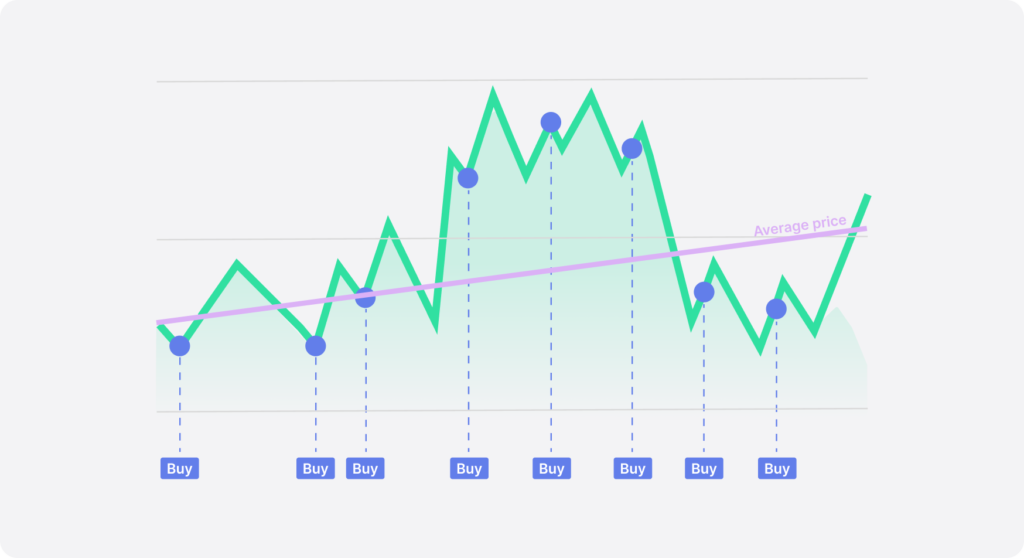

Dollar-cost averaging is an investment strategy where an investor divides the total amount to be invested across periodic purchases of a target asset. This systematic approach spreads the investment over time, reducing the impact of volatility and the risk of making a large purchase at an inopportune time.

How DCA Works

Instead of investing a lump sum in a cryptocurrency, you invest a fixed amount at regular intervals, regardless of the asset’s price. For example, you might decide to invest $100 in Bitcoin every month. This means you buy more when prices are low and less when prices are high, averaging out the cost of your investment over time.

Why Use Dollar-Cost Averaging?

Cryptocurrency prices can fluctuate wildly within short periods. By spreading your investments over time, DCA reduces the impact of these fluctuations, providing a smoother and less stressful investment experience.

Eliminating Timing Risk

One of the biggest challenges in investing is deciding when to buy. DCA removes the need to time the market, as investments are made consistently over time. This reduces the risk of making poor decisions based on market emotions.

Advantages of Dollar-Cost Averaging

- Simplicity and Convenience

DCA is straightforward and easy to implement. It doesn’t require constant monitoring of the market or complex analysis, making it ideal for beginners. - Reducing Emotional Investing

Investing a fixed amount regularly helps investors avoid the emotional highs and lows of market swings. This disciplined approach prevents impulsive decisions that could lead to losses. - Potential for Lower Average Costs

By buying at different price points, DCA can result in a lower average cost per unit over time, especially in volatile markets. This can enhance long-term returns.

Disadvantages of Dollar-Cost Averaging

- Limited Gains in Bull Markets

In a consistently rising market, a lump sum investment might outperform DCA, as the latter spreads purchases over time, potentially missing out on rapid gains. - Requires Discipline

DCA requires commitment and discipline to stick to the investment schedule. Skipping or delaying investments can undermine the effectiveness of the strategy. - Opportunity Cost

DCA ties up capital over a longer period. If the market is performing well, investing a lump sum initially could yield higher returns compared to spreading investments out.

Tips for Successful Dollar-Cost Averaging

- Choose the Right Asset

Select a cryptocurrency with strong fundamentals and long-term growth potential. Research the asset thoroughly before committing to a DCA plan. - Be Consistent

Stick to your investment schedule regardless of market conditions. Consistency is key to maximizing the benefits of DCA. - Diversify

Consider applying DCA to multiple cryptocurrencies to spread risk and increase potential returns. Diversification is a core principle of sound investment strategy. - Stay Informed

Keep yourself updated with the latest news and trends in the cryptocurrency market. While DCA reduces the need for active trading, staying informed can help you make better long-term decisions.

Summary

Dollar-cost averaging is a powerful and accessible strategy for those new to cryptocurrency investing. By spreading investments over time, DCA reduces the impact of market volatility and eliminates the need to time the market. This disciplined approach can lead to lower average costs and a more relaxed investment experience. To learn more about investing strategies, click here.